Here's everything you need to know about $GME and $AMC

Let's set the the table: $GME $AMC $NOK $BB and others are only are happening because the market presented an opportunity. The massive short sells on stocks presented an opportunity (a “short squeeze”): if we can get enough people to buy a stock, we can get the price to increase forcing the hedge funds to have to cover their shorts by buying the stock at a higher price to close out their position (usually due to their broker requiring them to put up more cash because they’re losing money so fast. This is a “margin call”).

And it works. In fact, it works so well that these hedge funds are working really hard right now to scare retail investors off these stocks by further manipulating the markets. Now apps like Robinhood are not allowing retail investors (its core user base) to buy additional shares of these companies (you can only close out / sell positions). So much for the name of the company, right?

How do I feel about this?

It’s incredible to see how a community made up of more than 3 million individuals with thousands of dollars can make as much of an impact as a hedge fund in the market. It’s a super powerful thing to see.

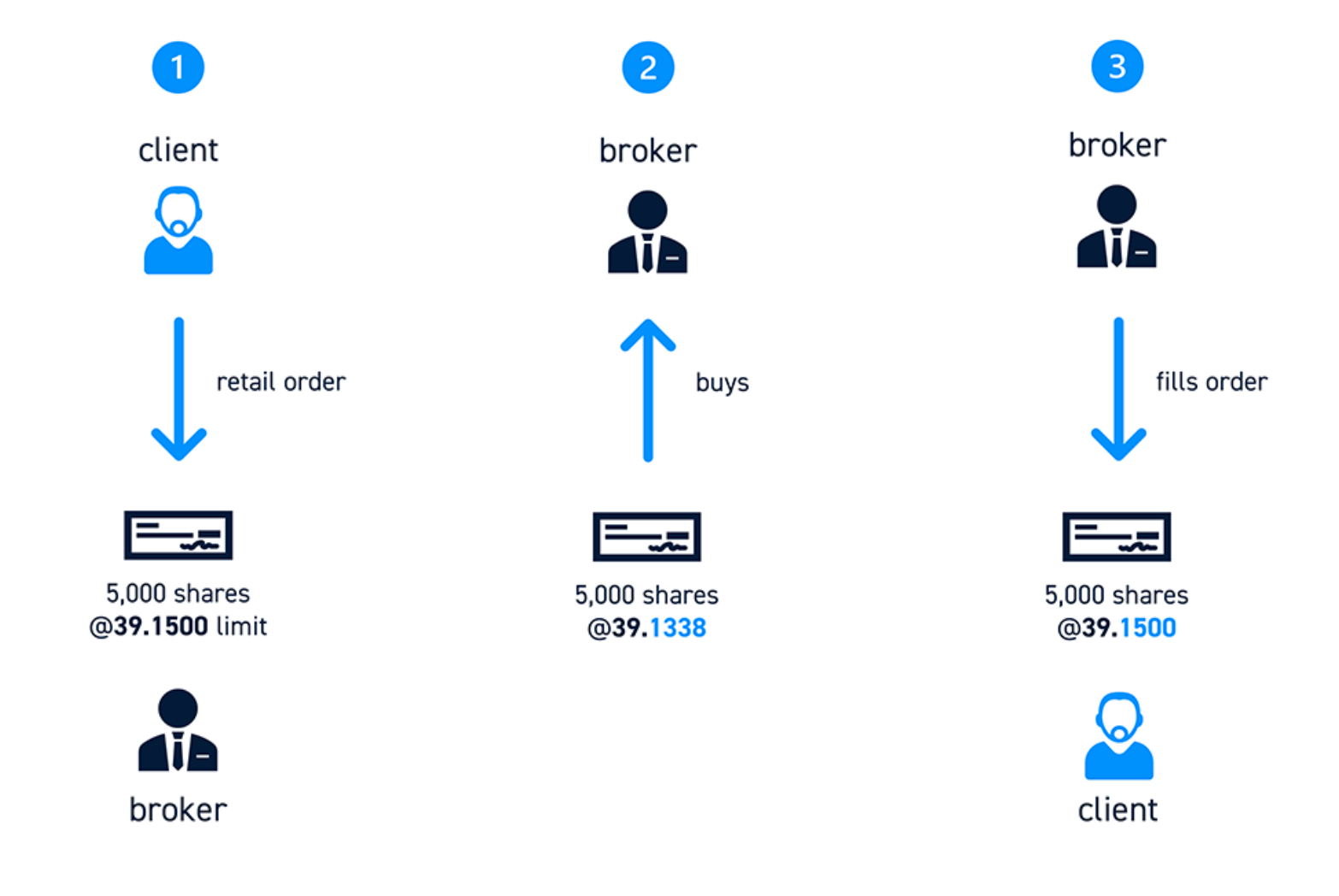

That being said, what we’re seeing as a response to what the retail investor is doing, is very disturbing. Robinhood is basically owned by these hedge funds, when you go to sell a stock, these hedge funds essentially buy the stock, increase the price, and then make money when you sell. That’s how they make their money, they’re beholden to these hedge funds.

In fact, Citadel accounts for 40 out of every 100 shares traded by individual/retail investors in the United States.

That's one company responsible for 40% of market-making.

When volatility increases, spreads widen, and they make even more money.

Citadel made $4.1B in profit last year.

This is a great diagram that explains it:

I doubt they ever expected their user base to bite the hand that feeds them (Robinhood). How could they? Except for the fact they are partially responsible for this happening. They provided the tools that enabled retail investors to buy and sell stocks/options with ease and at no cost.

What WallStreetBets did is not illegal. I believe in free trade and right now we're being denied the ability to trade freely.

So what should you do?

To avoid selling too early, you need to keep an eye on the short interest - the amount of shares shorted out there - and look for it to start to decline substantially. As long as nobody is defecting and nobody is selling early, that decline in shares shorted would come with a spike in the price of the stock, as the few shares available are bought at astronomical prices. And this decline in shares shorted would distinguish this spike from gamma squeezes or regular old stock run-ups.

Then and only then, as the nuke goes off, the stock price skyrockets to the moon and the short interest finally starts declining, the short squeeze has begun and that my friends, is when it'll likely become every investor for themself.

I personally invested some money in $AMC and I’ll be watching intently to see how this all plays out. One thing’s for sure: so far this is some bull. I'll be releasing a podcast on this topic next week, stay tuned!

Update: I sold my $AMC shares on 2/3/21 for a small loss – these guys don't play fair and it's exactly why I as I mentioned in my podcast episode, day trading is a risky proposition.

Also watch Chamath on CNBC: